30+ if i pay extra on my mortgage

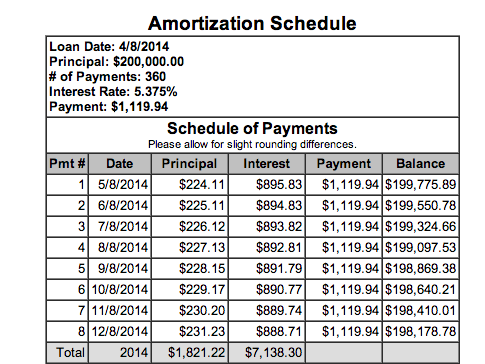

Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. Web Heres how extra payments would affect a 220000 30-year mortgage with a 4 interest rate.

Extra Mortgage Payment Calculator Accelerated Home Loan Payoff Goal

Web Assuming you have a 200000 30-year mortgage at a 4 interest rate youd need to pay about an extra 500 a month toward your principal to drop your.

. Comparisons Trusted by 55000000. Web For example lets say youre five years into a 30-year mortgage at a 35 annual percentage rate APR with a 500000 balance remaining. Web Paying off your mortgageespecially if you can pay it off earlyis a great way to liberate your saving and spending capacity.

What to consider carefully before investing or paying extra on your. Compare Lenders And Find Out Which One Suits You Best. Web If you make your regular payments your monthly mortgage principal and interest payment will be 955 for the life of the loan for a total of 343739 of which 143739 is.

Web You borrow 200000 using a 30-year mortgage loan. You may be able. Looking For a House Loan.

55 towards interest 45 towards principal. Youll find it on your mortgage statement. You decide to increase your monthly payment by 1000.

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Web Youll pay less for the home over the term of the mortgage than you would have with the lower 30-year rate. But with a bi-weekly.

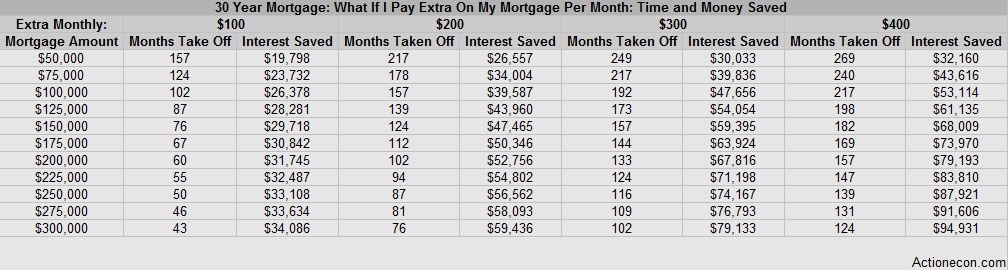

If you pay 200 extra a month towards principal you can cut your loan term by more than 8 years and. If you dont have an. If you used a 10000.

Your fixed interest rate is 325. Web What happens if I pay an extra 200 a month on my 30 year mortgage. For example if you pay.

Web You have a remaining balance of 350000 on your current home on a 30-year fixed rate mortgage. Ad 5 Best House Loan Lenders Compared Reviewed. Web Paying extra is the cheap easy way to pay off your mortgage early.

Web What happens if I pay an extra 300 a month on my 30 year mortgage. The payoff quote will say exactly how much principal and interest you need to pay to own. And thats a long time to pay interest.

Pay Off Your Balance In Cash. How Much Interest Can You Save By Increasing Your Mortgage Payment. If you have a mortgage chances are its a 30-year loan.

This amortization schedule shows that paying an additional 300 each month will shorten the life of the. Web Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether. Web Paying extra on a mortgage may help reduce the amount of interest paid over time in addition to the total amount of time it takes to pay back your mortgage.

The length of your original. Web Paying extra on your mortgage means that you make additional payments to your principal loan balance beyond your regular payments. Web Have your loan number handy.

Make one extra payment each quarter to shave 11 years and. Web When you refinance your home you can pay off your home faster by replacing your 30-year mortgage with one thats a shorter termWith a mortgage.

Should You Pay Off Your Mortgage Or Invest The Cash

Should You Make Extra Mortgage Payments Compare Pros Cons

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/xlmedia/TICQ64YXNJB4TDVOYBXSLCBJGA.jpg)

How To Pay Your 30 Year Mortgage In 10 Years The Dough Roller

Extra Mortgage Payment Calculator What If I Pay More

Early Mortgage Payoff Calculator

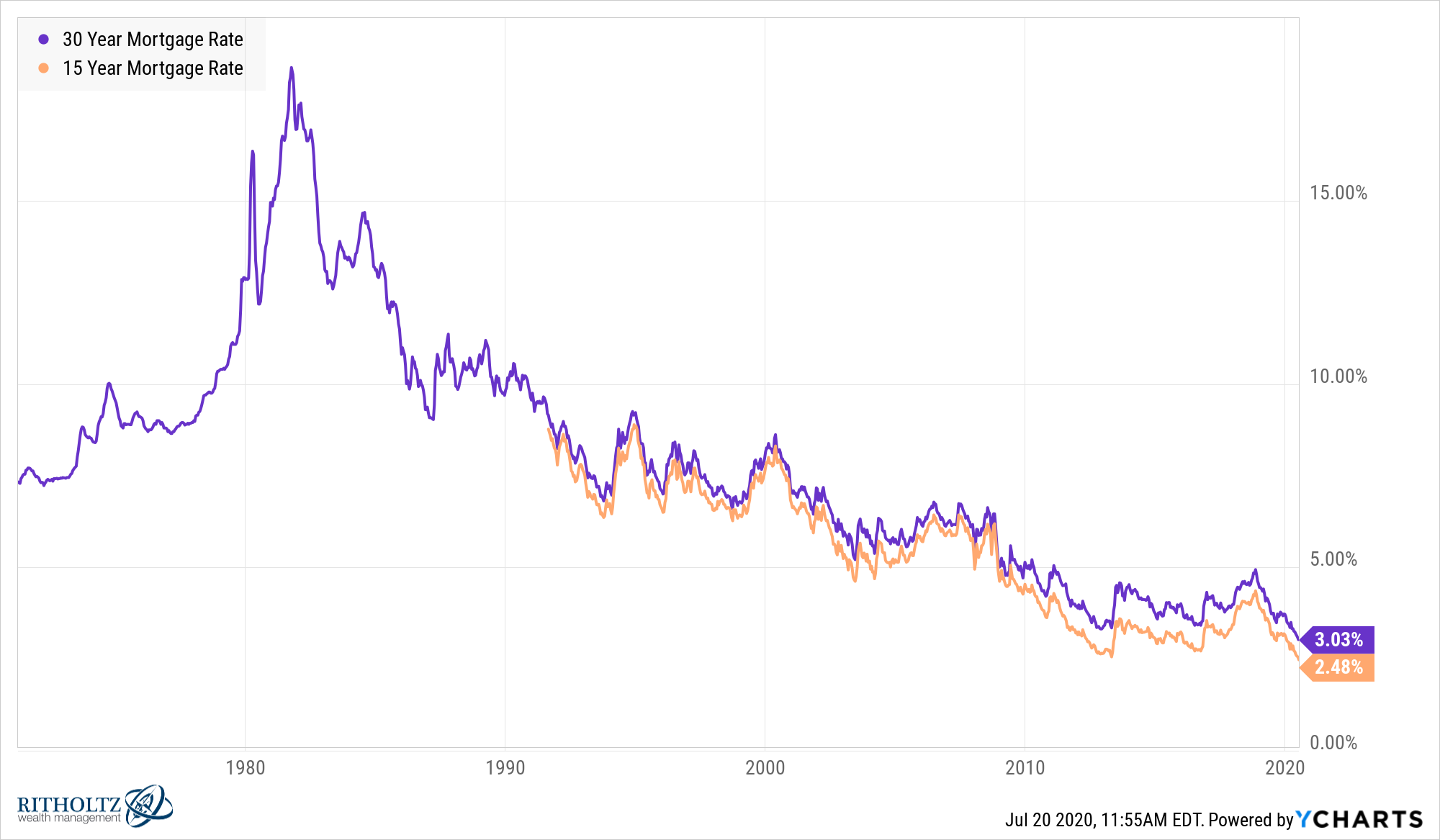

Mortgage Rates Are Insanely Low

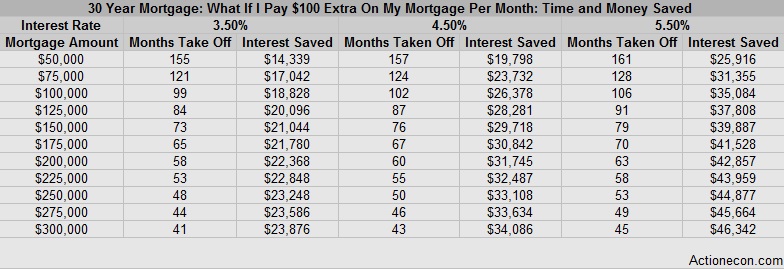

What If I Pay 100 Extra On My Mortgage Action Economics

Early Mortgage Repayment Calculator Paying Extra On Your Home Loan With Bi Weekly Payments

Extra Payment Mortgage Calculator Making Additional Home Loan Payments

![]()

Extra Mortgage Payment Calculator Accelerated Home Loan Payoff Goal

What If I Pay 100 Extra On My Mortgage Action Economics

Can I Get A 30 Year Mortgage In Canada Nesto Ca

Home Loan Extra Repayment Calculator Cut Years From Your Mortgage

Extra Payment Mortgage Calculator Making Additional Home Loan Payments

10 Strategies For Paying Off Your Mortgage Early

Should I Pay Off My Mortgage Early Or Not My Money Design

Understanding The Details Of Your Mortgage Payment Homewise